THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Did you know that over time, your money becomes less valuable?

That’s right, every year that $1 in your wallet is worth less and less.

And sadly, the money sitting in your bank account also is losing its value.

How is this possible?

It is all thanks to the effects of inflation.

The good news is there are things you can do to limit the ramifications inflation on your wealth.

In this post, I am going to show you the effects of inflation on your wealth and the simple things you can do so that you aren’t losing money to inflation.

Table of Contents

The Deadly Effects Of Inflation On Your Wealth

What Is Inflation?

What Is Inflation?

Before I get into what inflation does to your wealth and what steps you need to take to limit it, we first need to make sure you understand the definition of inflation.

The simplest way to describe inflation is that every year, the cost of products and services increase.

As a result, the purchasing power of a dollar decreases.

In other words, what costs $1.00 today will cost more next year based on the inflation rate, thus making your dollar less valuable, and the cost of living more expensive.

If inflation is 3%, then that $1.00 item today will cost $1.03 next year.

Another way to look at it is like losing weight.

When you first start out, you determine how many calories you need to maintain your current weight.

Then you subtract 500 from this number if you want to lose 1 pound per week.

After a couple months, you need to recalculate how many calories you need because you weigh less and therefore need fewer calories to survive.

To you as a consumer, it is not ideal to pay more for the items you need to buy.

But the reality is a consistent level of inflation is a good thing.

This is because it shows that a healthy economy as a whole is growing.

As an economy grows, more jobs are created, and more people are working.

This results in higher wages.

And with more income, consumers spend more, and buy more goods and services.

The tricky part about inflation though is keeping it under control.

This is why you hear so much talk about The Federal Reserve raising or lowing interest rates through monetary policy.

They are doing so in hopes to keep inflation in check.

If the economy grows too quickly, so too does the resulting money supply.

This could lead to a spike in inflation, called hyperinflation, which is bad.

Hyperinflation

Hyperinflation is a type of inflation on steroids.

The economy grows too fast.

Demand outweighs supply and businesses react by hiring workers and paying constantly higher wages.

As the cycle progresses, prices for goods rapidly increases, leading to worthless currency.

I use the term worthless because as prices rise, small denomination bills cannot be used. Central banks begin to print large denomination bills.

No one wants to hold on to or save money because they need to buy goods before the price increases even more.

There are examples in history of hyperinflation.

In the 1920’s, the German economy was in shambles, so Germany was printing 2 trillion Mark banknotes.

To put this into perspective, the exchange rate to US Dollars was 1 Dollar to 4 trillion Mark.

That means if you had a $1 bill in your pocket, you had 4 trillion in German currency!

This might sound awesome, but realize that a single postage stamp would cost you 50 billion Mark.

Another example is Zimbabwe in 2008.

Hyperinflation was so bad, buying a single egg would set you back over a billion dollars.

Deflation

Deflation is another type of inflation and is the opposite of inflation.

With the effect of deflation, instead of you needing more money to buy the same amount of goods next year, deflation allows you to buy more goods for the same amount of money next year.

While this sounds great, it is actually a negative impact of inflation.

In order to have deflation, an economy needs to have a greater supply of goods than there is demand for.

When the supply is greater than consumer demand, prices drop.

Think of this like a sale at the grocery store on yogurt. The grocery store ordered more yogurt than there is demand for.

In order to sell it all, the store drops the price. In a way, this is deflation, just on a very small scale.

When the demand for all goods drops, businesses will stop producing goods since there are too many items in the market, meaning workers will lose their jobs.

This means less people will be buying goods since fewer people have income.

For those with an income, they will delay purchases since prices continue to fall.

After all, why buy a car for $25,000 when in a few months you can buy it for $18,000?

On a greater scale, banks will stop lending money to consumers too.

Why lend $100,000 to someone to buy a house and end up getting less at the end of the loan because the value of money keeps dropping?

Furthermore, people with money will stop spending it.

If you have $10 today, as prices drop, tomorrow you might be able to buy $20 worth of goods with that same $10.

There is a great example in real life with deflation.

The Great Depression was the US economy experiencing deflation.

People lost their jobs as the stock market crashed. They held onto cash for fear of not having any money.

With no one buying anything, supply grew and prices crashed.

Deflation is a dangerous cycle and everything is done to avoid it.

Hidden Inflation

There is also the idea of hidden inflation.

This type of inflation has taken advantage of you, you just might not realize it.

Hidden inflation is when companies keep the price of an item the same, but lessen the quantity that you get.

A quick walk through the grocery store will show you countless examples of hidden food inflation.

A half-gallon of orange juice costs $3.99 where I live. The only problem with this is that I am not buying half a gallon.

A half-gallon is 64 ounces. But the container of orange juice is only 58 ounces.

So, while the price technically didn’t increase, it really did since I am getting less orange juice.

Hidden inflation is everywhere, so make sure you take your time when buying items, especially at the grocery store.

Be sure to compare the unit prices of goods and not the price you see.

The unit price will more accurately tell you the true cost of an item.

What Can You Do About Inflation?

Now that you understand inflation, is there anything you can do about it?

While you cannot control the rate of inflation, you can limit the impact of inflation by taking action with your money.

Historically, the average rate of inflation is 3% per year.

Therefore, to limit the what inflation does to your wealth, you need to take steps to make sure that you are earning at least 3% interest on your money.

This will ensure that you are not losing money each year to inflation.

What are your investment options when it comes to earning 3% or more?

You have a few.

- Bank savings products

- Alternative investments

- Stock market

- Real estate

Let’s look at each one in detail.

Bank Savings Products

These are typically your savings accounts and certificates of deposit.

Your money is guaranteed by FDIC insurance up to $250,000.

The problem with this option is as the Federal Reserve changes interest rates, the interest you earn on your savings changes.

Right now, most bank savings account are paying 0.05% interest.

CLICK HERE FOR MY SAVINGS ACCOUNT COMPARISON

Knowing that inflation averages 3%, you can see that you will be losing money in terms of purchasing power here.

But there are some online banks that pay a higher interest rate.

- Read now: Click here to learn about CIT Bank

- Read now: Click here to learn more about Capital One 360

At the end of the day, you need to have savings for a rainy day. Having a savings account is a great option.

Just don’t leave too much money in the account, otherwise you will lose purchasing power over time.

Alternative Investments

Recently there have been some alternative investments to a bank account that are worth looking into.

These investments are loans given to small businesses and you as the investor earn interest.

For example, with Worthy Bonds, they give a small business a loan and charge them 8% interest.

You buy a bond, which is part of the loan and earn 5% on your investment.

This investment is classified as a bond, but I see it as a modified savings account.

As a result, we have money in a savings account for any immediate emergencies where we need cash in the moment.

Then we have money with Worthy Bonds earning 5%.

Since we can get access to this money in a couple days, it is worth the investment.

Stock Market

On average, you can expect to earn 8% annually on your money that you invest.

This outpaces the inflation rate and is a good hedge against inflation so you don’t have to worry about losing purchasing power.

But, you can lose money in the stock market.

This is why the stock market is not a good play to put your emergency savings.

You are better investing money you don’t need for 5 years or longer. Investing for retirement is an example.

Real Estate

Real estate returns for personal residences average 3% historically.

This means you will keep pace with the inflation rate over time.

The downside to real estate is your money is locked up.

What I mean by this is you can’t get access to this money like you can with your savings account.

While you could take out a line of credit, this would defeat the purpose as you are now paying interest on the money you are borrowing.

Tangible Assets

These are things like gold and art that tend to increase in value over time.

Many people use gold as an inflation hedge because it is something that is always in demand.

Issues With Inflation Over Time

Since the inflation rate changes annually, I put together this historical chart of inflation rates.

You will see the year and the annual inflation rate for that year below.

| Year | Inflation Rate |

|---|---|

| 2020 | 1.23% |

| 2019 | 1.81% |

| 2018 | 2.44% |

| 2017 | 2.13% |

| 2016 | 1.26% |

| 2015 | 0.12% |

| 2014 | 1.62% |

| 2013 | 1.47% |

| 2012 | 2.07% |

| 2011 | 3.16% |

| 2010 | 1.64% |

| 2009 | -0.34% |

| 2008 | 3.85% |

| 2007 | 2.85% |

| 2006 | 3.24% |

| 2005 | 3.39% |

| 2004 | 2.68% |

| 2003 | 2.27% |

| 2002 | 1.59% |

| 2001 | 2.83% |

| 2000 | 3.38% |

| 1999 | 2.19% |

| 1998 | 1.55% |

| 1997 | 2.34% |

| 1996 | 2.93% |

| 1995 | 2.81% |

| 1994 | 2.61% |

| 1993 | 2.96% |

| 1992 | 3.03% |

| 1991 | 4.25% |

| 1990 | 5.39% |

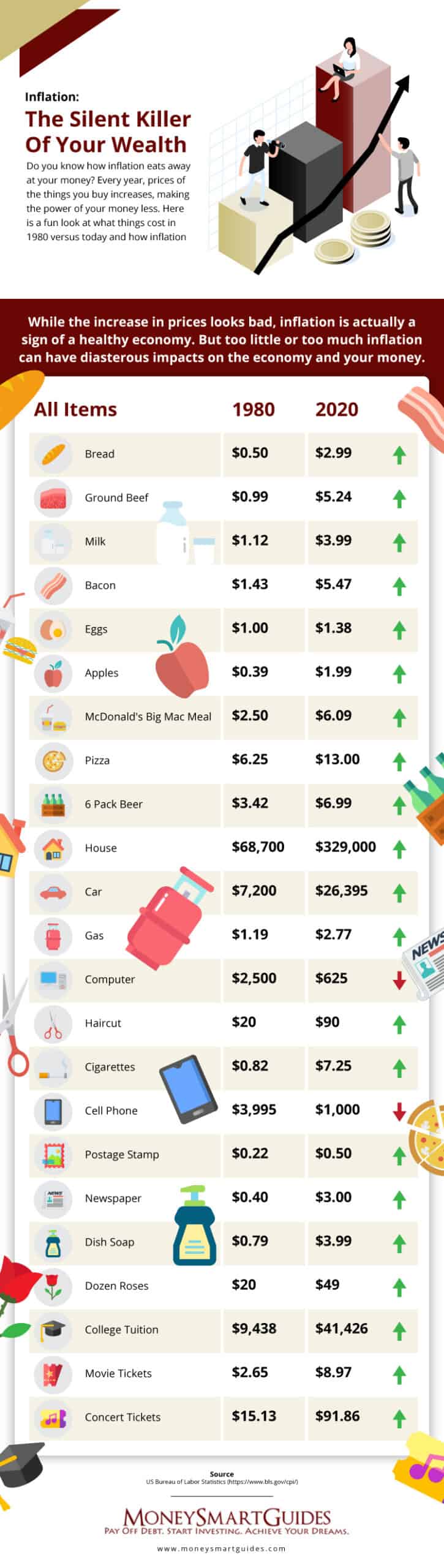

How does this compute to the things you buy?

Here is a cool infographic showing you the increase in prices over the years.

Frequently Asked Questions

Understanding inflation can be confusing to many. As a result, I get a lot of questions.

Below are the most common questions about inflation.

What is the positive effect of inflation?

The positive effect of inflation is an economic expansion and a strong economy.

People are working and earning higher incomes, and as a result are spending their money.

This increase in demand drives prices up.

What is the negative effect of inflation?

There are a few negative effects of inflation. First, if prices rise too quickly, the money you have buys less and less.

Before you know it, it will cost you $50,000 to buy a gallon of milk in hyperinflation takes off.

Alternatively, if the economy goes south and the labor market dries up and people stop buying things, deflation can set in.

Here prices keep dropping because no one wants to spend the little money they have on something that is losing value quickly.

How can we control inflation?

The Federal Reserve, also called the Central Bank, controls inflation through its monetary policy.

They raise and lower interest rates based on the economy.

It can also tinker with the supply of money by injecting money into the system or taking money out of the system as well.

It is a very detailed balancing act of monetary policy to keep inflation in a set range so as to not hurt or harm the economy or consumers.

How is inflation calculated?

In the United States, the Bureau of Labor Statistics takes a measure of inflation on an annual basis.

They take a basket of goods and services along with their prices.

They then compare the prices to various periods.

From there, they average and weight them based on various formulas to get to the Consumer Price Index (CPI).

This number is then used to come up with the rise in inflation.

For example, you would take the CPI from last year and subtract the CPI from this year.

You then take the result and divide it by last year’s CPI to get the inflation rate.

If last year’s CPI was 245.968 and this year’s is 248.785, you would take 248.785 minus 245.968 to get 2.817.

You then take 2.817 and divide by 245.968 to get and inflation rate of 0.0115 or 1.1%.

Does anyone benefit from high inflation?

Any benefits from high inflation will be short lived if the Federal Reserve doesn’t step in to slow the rate of growth.

In the short term, investors and companies can benefit from high inflation.

For companies, they will see their profits rise, which could lead to higher bonuses.

And for investors, companies having rising profits will see higher stock prices.

What is the demand-pull effect?

Demand-pull inflation is when the supply of money increases to a point that it outweighs demand in the economy.

This leads to a rise in prices since demand is stronger than the supply of goods.

What is the cost-push effect?

Cost-push inflation is when upward pressure and higher costs in the production process leads to higher prices.

For example, if the price to produce lumber increases, everything you use lumber for will increase in price.

Eventually you will see this price increase reflected in the housing market.

It’s a trickle down effect.

The same idea applies to oil supply.

If the costs to produce oil increase, everything that requires oil to operate will see an increase in prices as well, including gas prices.

What Is Lifestyle Inflation?

Lifestyle inflation is different from traditional inflation.

Where the inflation talked about here is about the value of your purchasing power, lifestyle inflation is about your standard of living increasing as your wealth increases.

This type of inflation is 100% controlled by you and there are many things you can do to avoid it.

- Read now: Here is how to limit lifestyle creep

Final Thoughts

As you can see, inflation is something we have to deal with.

A steady inflation rate means that the economy is growing and that it is healthy.

So while it isn’t the ideal that our money is losing value, the good news is that the economy is growing.

This means jobs are plentiful, raises are happening, and the stock market is rising.

The Federal Reserve does all it can to keep inflation in check so that we don’t experience hyperinflation or deflation, which are the two types of inflation we want to avoid at all costs.

At the end of the day, make sure you keep in mind how inflation has an impact on your money.

Save money in a savings account to cover emergencies, but try to get a high interest rate.

Then be sure to put the rest of your money in higher earning investments so inflation doesn’t silently steal rob you of your wealth.

- Read now: Learn how to long to keep financial statements

- Read now: Find out how to calculate your net worth

- Read now: Discover the difference between tax credits vs tax deductions

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

This is a great breakdown Jon! I find that many do not understand it, thus the buying power analogy is often a very good one. Like you said, a steady rate is one thing and is expected, but can be bad if it gets too high.

This is something you must account for. I know that a lot of companies are not even giving that annual raises so staying at your current position and not getting increases in salary could be hurting you a lot when you add inflation. Really great job on the breakdown. Another reason to invest in things that earn interest, a savings account with .045% just doesn’t cut it.

I know a few people that haven’t received raises and are struggling more now because of the increase in prices.

That’s a great breakdown on how inflation works. I have been grappling with the impact of inflation on my mortgage recently. I have a loan a 2.875%. If inflation is higher than that each year, I actually make money by having debt. Weird to think about, but mathematically it makes perfect sense.

That’s great that technically you are making money by having debt! I’d love to have that low of an interest rate but my house is underwater and I can’t get a refi for a lower rate.

Great information! I’d be interested in followup post about the CPI and market basket. To me this is a subject that makes sense in theory but the more I think about it, the more confusing it gets.

It’s funny how some things are like that. You think you understand it, but then the more you think about it, the more you don’t!

Great information here! I have found it’s fun trying to explain these concepts to high school kids who don’t really understand why prices keep going up…especially in our school cafeteria.

How do you get through to them? I’d be interested in hearing if you need to get creative for them to be interested in it.

Great article which describes inflation in a nice and reader-friendly way. Personally I always had trouble in understanding how it can just fly out of control in less developed countries and the money become worthless, but I guess thats another story.

Like Eric I have a super low mortgage and don’t plan on paying it sooner thanks to inflation. It is strange how some things do change a lot in price while other remain the same or cheaper (like internet or the cost of a laptop).

Thanks for the educating post Jon. Now I really know what inflation is.

This post about inflation is very informative. I understand it more easily here than when my professor was teaching this in front of our class back then. Thanks!

I’m always surprised as to how little both individuals and companies take inflation into effect. Our economy goes through cycles of hyperinflation, normal inflation.. all sorts of things, and it’s very important to understand how it works so you can do the best you can possibly do with savings and investing.

I can give you a graphic example. When I started work in 1978 my salary was $18,000. Sounds pretty low, right? But if you put it in 2021 dollars it looks a lot better. Adjusted for all the inflation since 1978 my starting pay was equal to $74,318 in 2021. That’s not shabby at all for a kid right out of college!