THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

We all want to be financially free.

The problem is, many of us don’t see the path to making this dream a reality.

Or we see the wrong path, which makes it look a lot harder than it actually is.

Today, I am going to share with you the right path.

This path will show you how investing $250 a month makes you a millionaire.

In this post, I break down how this is possible the best investments based on your goals and risk tolerance to make it happen.

By the end, you will have the plan laid out for you and all that will be left to do is start investing.

Table of Contents

How Investing $250 A Month Makes You A Millionaire

How Much Will $250 A Month Grow In To?

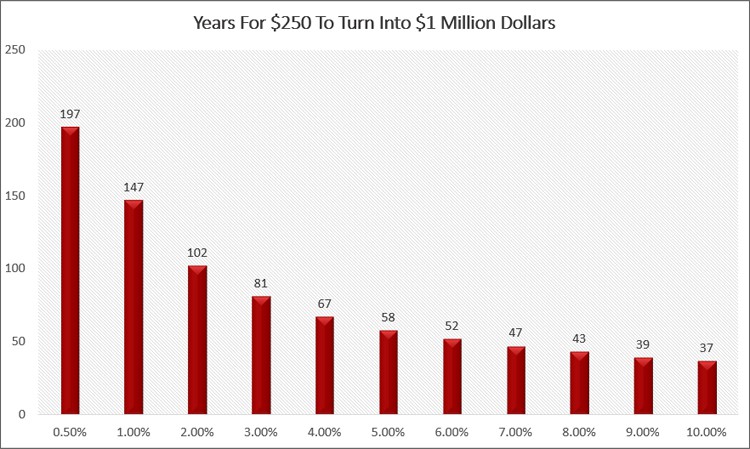

The first thing we have to understand is how long it will take our $250 monthly investment to grow into $1 million dollars.

Understand that different investments have different rates of return, making the time it takes to reach your goal longer or shorter.

The chart below breaks this down for you.

As you can see, if you earn 8% annually, which is the historical average return you can expect from the stock market, you will become a millionaire in 43 years.

On the other hand, if you earn 5% annually, which is what you can expect to earn from some alternative investments, you will become a millionaire in 58 years.

And if you put your money into regular savings accounts at a bank, you would earn an annual return of around 0.50%.

I did also note that online savings accounts will earn you a higher yield, closer to 1.50%.

The Benefits Of Investing Monthly

Investing every month is also known as dollar cost averaging.

It works because it helps investors take the emotion out of investing.

This is because you put your extra savings to work on a regular basis.

When stocks are priced lower, you buy more shares.

When stocks are priced higher, you buy fewer shares.

In other words, dollar cost averaging helps you to buy more when prices are low, which allows your more.

The other option you have is to invest all at once, or in a lump sum.

This is also a good way to invest.

The only problem is that very few people have a large amount of money to invest at once.

As a result, dollar cost averaging allows you to invest with small amounts of money.

Factors That Decide What You Should Invest In

Now that you know how long it will take your money to grow based on the rate of return you earn, we need to talk about the factors that play a role in determining where you invest your savings.

Obviously, we all want to grow our money as quickly as possible.

But risk and return are related.

Put another way, to earn a higher return, you also have a higher chance of losing money.

For example, let’s say you need to get to work.

You can drive the speed limit and get to work in 30 minutes.

Doing this, you won’t face many risks.

Now do the same drive at 100 mph.

While you will get there earlier, which is a better return on your time for driving faster, you also face more risks.

You could get a speeding ticket or you could lose control of your car and crash.

The same applies to your savings.

The lower your investment return, the fewer chances of losing your money.

The higher your investment return, the more chance you have of losing money.

Understand that this doesn’t mean you should never invest in a higher return investment.

It just means you need to account for the below factors.

#1. Your Financial Goals

The first step is you need to consider is your goals.

These will make up your investment objectives.

Why are you investing in the first place?

Are you looking to use the money for retirement?

What investments will make up your investment portfolio?

Do you want to save for a vacation or a house?

You need to have an investment strategy with your money before you know how to invest it.

#2. Your Time Horizon

Once you know your goals, your next step is to know your time horizon, or how long until you need the money.

If you are looking to grow your savings for a long period of time, say 30 years, investing in the stock market is a great option.

Sure there will be years when the market is negative and your investments lose value, but overall, if you stay invested, your investments will grow.

On the other hand, if you need the money in 3 years, then stock investments aren’t the best option for it.

There is too great a risk that the market will be down in one of those years and you won’t end up building wealth.

#3. Your Risk Tolerance

You have your goals and how long until you need the cash.

Now you have to understand how much risk you are comfortable taking with the cash you save.

As I mentioned earlier, risk and return are related.

The more comfortable you are with taking chances, the higher return you can try to earn.

But you have to determine what your risk tolerance is.

Getting your risk profile dialed in is critical to long term investing success.

It will also play a big role in the investment decisions you make, both now and in the future.

For example, if you take on more market risk than you are comfortable with, you will probably react emotionally when the stock market drops.

- Read now: See how your emotions impact your investment success

- Read now: Learn how to invest when you are too scared to invest

This will cause you to sell your investments, and end up with very little money compared to what you were expecting.

On the other hand, if you take on too little risk, you won’t achieve the investment returns you were planning on, forcing you to invest longer or put off some of your goals.

At the end of the day, you need to be honest with yourself and the risk you are comfortable with.

Getting this wrong is going to cause you a lot more pain than you can imagine.

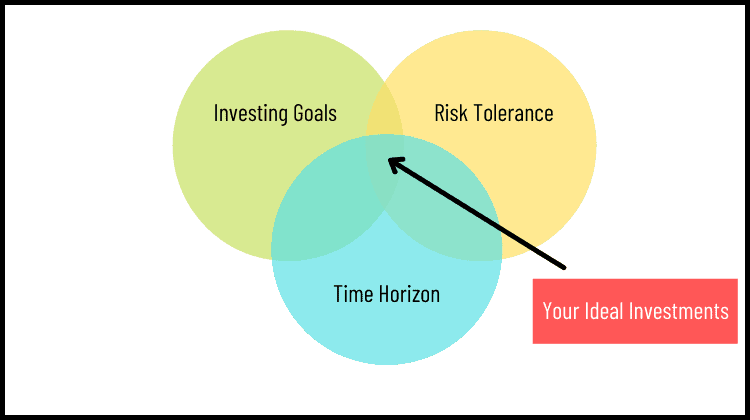

You need to find a healthy balance between your goals, your time horizon, and your risk tolerance.

When you put these 3 things together, you find the ideal investment for you.

What Are The Best Investments For You?

To help you with how to invest your money, I put together this list of options so you can figure out your ideal investing strategy.

While none are perfect for everyone, it is smart to look at each one and consider the pros and cons understand which one is right for your financial situation.

#1. 401k Plan

This is a great option for an investor investing for retirement.

Your money gets invested for the long term, allowing it to earn compound interest.

You also get the benefit of your monthly contributions being pre-tax, which means you pay less income tax as a result.

Finally, your contributions grow tax deferred, so you don’t pay taxes until you withdraw the money.

The downside to a 401k plan is that the money is locked in the account until you reach retirement.

- Read now: Here are the pros and cons of 401k plans

While you can take out a 401k loan to access your savings, or simply withdraw it, you face taxes and steep penalties making it not a smart investment for anything other than retirement.

Another downside is you are limited to how much you can invest as an annual contribution.

Once you max out this account, you cannot put any additional contributions into the account.

#2. Roth IRA

A Roth IRA is another great option for an investor investing in the long run.

Unlike a 401k, any investment in a Roth does not lower your taxable income.

But it does grow tax free.

This means even when you withdraw your savings, you do not pay any income tax on the gains.

The other benefit is you can withdraw some of your portfolio out before you reach retirement age.

- Read now: Here are the pros and cons of Roth IRAs

This only applies to your contributions however, not your investment gains.

There are situations you can take out more than just your contributions, like first time home buyers, but you should have the account for one goal and one goal only.

If you really want to save for a down payment on a house and for retirement, you might consider opening 2 Roth IRA accounts.

One for retirement and the other for the house down payment.

Finally, like the 401k, you are limited with how much you can contribute.

Once you max out this account, additional contributions are not allowed.

#3. Stock Market

This is the best way to invest assuming you don’t need the money for at least 5 years.

Anything less than this and you take a chance of losing some of the money.

But for longer term investing, very few, if any, investment options will provide a return like stocks.

And by having a brokerage account and not a retirement account, you can sell some of the stocks in your portfolio whenever you like, without the fear of penalty.

When investing your savings here, you can choose between individual stocks, mutual funds, or exchange traded funds.

- Read now: Learn the pros and cons of investing in stocks

- Read now: Discover the differences between mutual funds vs. ETFs

And while you will need to open an investment account with a broker, this is a simple process.

Finally, make sure you have a diversified portfolio so that you can limit any losses while still earning a healthy return.

#4. Bonds

I list bonds separately from the stock market, because these are better options than stock investments for the short term.

This is because you minimize risk compared to stocks.

If you need the money in 5 years or less, investing in bonds funds is an option.

Bonds tend to be less risky, so there is a smaller chance of losing a portion of your investment.

The downside is that most bond funds pay interest payments every month.

This sounds great, but this interest is taxed at ordinary income tax rates.

#5. Real Estate

Investing in real estate is a safe, long term investment alternative to the stock market.

And how you go about investing in real estate has changed dramatically.

Years ago, your main option was to buy a property and rent it out.

While you can still do this, there are other options if you aren’t interested in dealing with tenants or have the cash to put down to buy a place.

For example, you can buy a house and while you live in it, fix it up.

Then you can buy another house and rent out the first house.

Fix up or simply live in the second house for a few years and buy another house.

Then rent out the second house.

You can do this as many times as you like.

Another option is to invest in real estate investment trusts, or REITs.

A REIT is a professionally managed investment, very similar to a mutual fund.

The only difference is it invests in real estate and not publicly traded companies.

Once you make your investment, each month you earn dividends.

Over time the value of the REIT increases in value as well.

The downside here is most REITs invest in commercial properties and you have no say where these properties are located.

A solution to this is Arrived Homes.

Looking for an easy way to get started investing in real estate without a lot of money? Look into Arrived Homes. Pick the single family houses in the parts of the country you want to invest in and earn passive income.

Here you look at residential rental properties that are available to invest in and you select the exact ones you want to have ownership in.

It’s a great way to get started with real estate without the need for a lot of money.

And as an added bonus, investing in real estate offers a great return over the long term.

#6. Worthy Bonds

If your time horizon is short and you want to earn a decent return, Worthy Bonds is a great option.

With this investment, you give money to Worthy who then turns around and uses this money to loan to small businesses to fund their inventory.

The small business pays Worthy interest on this loan and Worthy turns around and pays you 5% compounding interest.

I’ve been investing with them for 3 years now and love not only how simple it is, but the steady wins I get from compounding returns.

I can even round up my purchases to invest money every single month.

Looking to safely earn a higher return on your money? Worthy Bonds offers 5% 7% interest on your money. Invest in small businesses and earn a return for doing so. New users get a $10 bonus when purchase your first bond.

#7. Savings Account

Another option for investors to invest $250 a month is a savings account at a bank or other financial institutions.

While your cash is safe from losing value, you won’t earn a very competitive interest rate compared to the other options listed.

Also, with a savings account, you take a chance of losing purchasing power in the future because of inflation.

With an inflation rate at 2%, you need to earn at least this interest rate.

Otherwise, you won’t have enough money to buy that same amount of goods as the future value of your cash will be less from inflation eating away at it.

Final Thoughts

At the end of the day, you have options for investing $250 a month.

And depending on your risk tolerance and when you need the money, you can turn your $250 monthly contributions into millions of dollars.

All it takes is doing the work to make sure you have a portfolio built for your goals and then staying invested so that compounding returns can work their magic.

- Read now: Here is how to survive a stock market correction

- Read now: Learn how to rebalance your portfolio

- Read now: Discover the major asset classes to invest in

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.