THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

If you want to achieve financial success, knowing your personal net worth is important.

However many people put their focus on their income instead.

They believe that if they earn a high income, they will become wealthy.

The reality is this is not true.

You could earn a high annual income and not be very wealthy.

And you could earn an average salary and be worth millions.

How is this possible?

In this post, I will show you the difference between income vs. net worth.

By the end, you will see the importance of both measures of wealth as well as a trick I use to compare the two to make sure I am moving forward financially.

Table of Contents

Income vs. Net Worth | Which One Is A True Measure Of Wealth?

Personal Net Worth

Your net worth is simply taking all the things you own, your assets, and subtracting their value from the things you owe, your liabilities.

The resulting number is your net worth.

For example, you would take the value of your liquid assets like bank accounts, investment accounts, retirement savings, etc. as part of your assets.

You would also take the market values of your personal assets, like cars, jewelry, art, real estate, etc.

This total number is your assets.

Your liabilities are your debts, like credit card debt, student debt, auto loans, etc.

If your assets total $100,000 and your liabilities total $40,000 your net worth is $60,000.

Income

To determine your income, we first will define it as your annual income.

For this we will use your annual income tax return.

Look at line 9 on Form 1040 and you will see your total income.

This is the amount of earned income from your job, plus additional income from tips, investment income like dividends and interest, capital gains, Social Security, and pensions.

The Problem With Wealth In The United States

What these numbers tell us are two things.

For your income, it is pretty straightforward.

It is telling you how much money you earn.

- Read now: Click here to learn the habits of rich vs. poor

- Read now: Here are the best high income skills to boost your income

Your net worth on the other hand, is telling you how much you are worth.

In other words, if you didn’t have an income and sold everything, this is how much money you would have to live off of.

Here is the problem with wealth in the U.S. as it relates to net worth and income.

Looking at one or the other can be misleading.

Take a look at this example as proof.

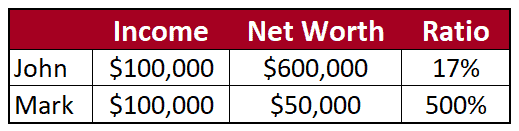

You have two doctors, John and Mark.

Both earn $100,000 per year. John’s net worth is $600,000 while Mark’s is $50,000.

With 6-figure incomes, you would think they were one of the middle-income families you hear so much about.

But if you look at their net worth, you see a different picture.

John has a strong financial position, while Mark doesn’t.

But what if Mark was making $30,000 a year and is one year out of college?

In this case his net worth would be pretty good.

Income To Net Worth Ratio

By using a ratio of both income and net worth, we can get a better idea of where you stand financially.

To calculate your ratio, simply take your income and divide by your net worth.

The lower the number, the better off you are financially because it means you rely less on your income to survive.

And this is critical when it comes to your retirement future as you will be living off your assets and not your income.

For example, the average millionaire’s ratio is 7%, meaning they don’t need much of an income to survive.

Now that you know this, let’s look back at our example of John and Mark.

If we take their ratio here is what we get.

John’s ratio is 17%, which is very good.

Mark’s on the other hand is 500%.

Remember, the lower the number the better.

While you may see Mark earning a high salary and “living the life” with his big house and multiple cars, he really is barely keeping his head above water financially.

In fact, Mark is really Stanley below:

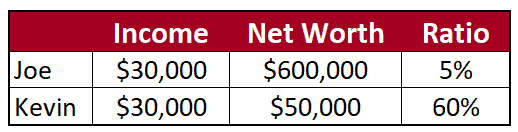

Using this ratio holds true for lower income people too.

Take Joe and Kevin for example.

They both earn $30,000 per year. Joe has a net worth of $600,000 while Kevin has a net worth of $50,000.

Joe has a ratio of 5% and Kevin of 60%.

This shows us that Joe is a master saver and is truly wealthy.

Kevin on the other hand saves some money, but could save more.

How To Increase Your Income vs. Net Worth Ratio

This is a relatively easy calculation to perform and it will give you a good idea of where you stand.

While earning money is important, it is more important to save as much of it as you can.

Saving and investing your money builds your net worth.

The higher your personal net worth, the better your ratio will be.

So what are some simple steps to improve your ratio?

Remember that your net worth is simply your assets minus your liabilities.

The more you save the higher your net worth will be.

So make it a point to review your spending habits and possibly reduce your standard of living a little bit.

Then take that money and save and invest it.

Here are some of the best ways to save money.

- Read now: Discover over 100 ways to save money

- Read now: Find out how to lower your monthly bills and save $1,000 a month

- Read now: Learn about 41 money savings challenges

- Read now: Discover the steps to save $100,000

While you might think that saving a few hundred dollars won’t matter, thanks to compound interest, in the long run, it will turn into thousands of dollars.

- Read now: Learn the power of compound interest

I recommend you run this ratio annually.

I do it after I complete my taxes, since I have the income number I need.

I just quickly calculate my net worth and do the math.

Then I enter the number on a spreadsheet so next year, I can see how much my wealth has improved.

Final Thoughts

There is the difference between income vs. net worth.

Don’t get caught up in earning the highest salary possible.

This is because in the long run, you need wealth, not a high income to for financial freedom.

Just because a person has a high salary, it doesn’t mean they are living like a king.

If you really want to be wealthy, forget about focusing on having a high income and focus instead on ratio between your income and your net worth.

- Read now: Here is your guide to stealth wealth

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

I use Quickbooks which also tracks net worth, but you have to input all your information. I’m pretty good at entering my expenses and income, but I often forget to update my pension plan annually and it doesn’t take into account my employer’s match, so the numbers will be off. If I were to guess my percentage, it’s probably no where near a single digit number!

I too have work to do. But, I look at it as a challenge and am willing to make the effort to reach my goal!

I track our net worth every month with a spreadsheet that I use for keeping up on all of our financial information. The ratios here are very interesting and will give me a different perspective.

I found this article very helpful and interesting. It does a good job of making the point that what you do with the money you make is more important that the amount of money you make.

On Question: When you refer to income, do you mean gross, net, or adjusted gross? Which number are you using? It can make a substantial difference.

Quicken allows for a good way to track net worth. And many accounts can be linked to update automatically. And no, I’m not plugging Quicken!

Thanks for a good article.

I prefer to use net income since it doesn’t take into account taxes.

Great post Jon. I think it can be so easy to focus on income alone, but as the saying goes it’s not what you make, it’s how you save it. Our ratio is a bit higher as well, due to the house, but we’re working fairly hard to bring that down.